The Challenge of Classifying Small Businesses

Expense classification, which is seemingly an ordinary but very tedious and error-prone task in bookkeeping, is a vital factor that determines the success of small businesses. Whether you’re managing a coffee shop or an e-commerce brand, accurate categorization influences your financial accuracy, tax reporting, and cash flow planning.

Conventionally, small businesses managed this on a manual basis and typically via spreadsheets or low-cost software. However, manual processes cannot withstand an increase in the volume of transactions. Chances of errors seep in. Deadlines are ignored. Time gets killed.

Today, thanks to AI tools for small business finance, there’s a smarter alternative: automated expense categorization. In this article, we’ll explore the debate between manual vs AI bookkeeping, and how small businesses can benefit from shifting to smart categorization systems that reduce human error and reclaim valuable time.

What Is Categorization of Manual Bookkeeping?

The traditional method of management of financial records is manual categorization. A proprietor or accountant goes through each transaction and classifies it by hand, normally in a spreadsheet or a straightforward accounting software program.

- Although this approach provides complete control, it has an enormous price:

- There is a large risk of mislabeling expenses

- Overlooked tax deductions

- A greater time for finance reporting and decision making

- That will go downward as you scale your business.

In today’s fast-moving business environment, manual vs AI bookkeeping isn’t just a tech conversation it’s a productivity one. Manual categorization may work for very small operations, but for growing businesses, it’s time to consider the benefits of small business accounting automation.

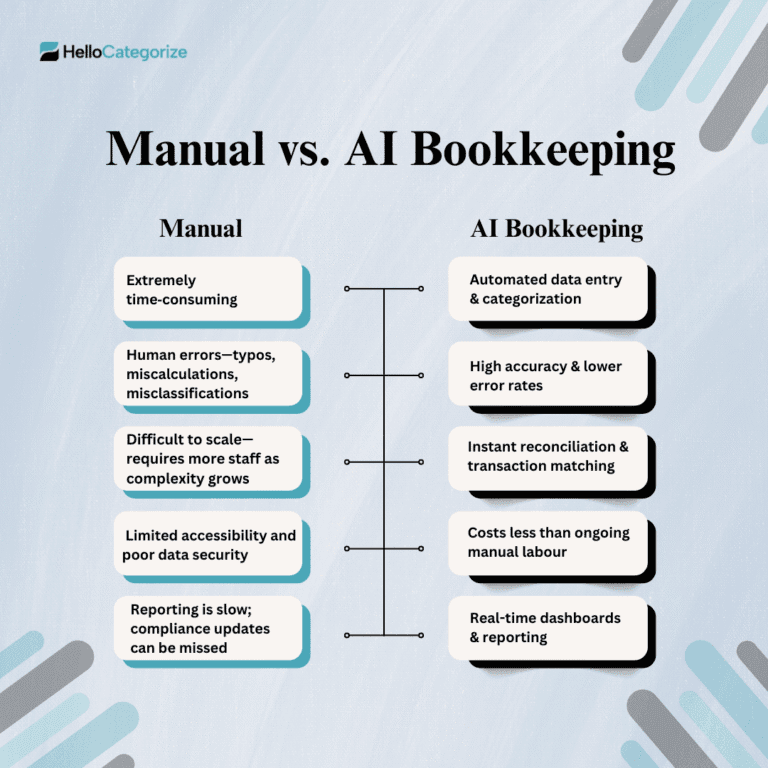

Manual vs AI Bookkeeping: Difference

There are obvious benefits of automating bookkeeping when it comes to manual vs AI bookkeeping, particularly for small business owners who have little time to waste or risk.

| Feature | Manual Categorization | AI Categorization (HelloCategorize) |

|---|---|---|

| Speed | Slow, time-intensive | Instant, real-time processing |

| Accuracy | Inconsistent, prone to human error | High accuracy, improves with usage |

| Scalability | Limited to team bandwidth | Easily scales with growing transactions |

| Consistency | Depends on user input | Maintains logical categorization standards |

| Cost | Higher due to labor | Lower long-term operational costs |

The Economic Consequences of Sloppiness in Bookkeeping among the Small Businesses

Manual bookkeeping is prone to errors, which are expensive. It is possible that one miscategorized expense can result in incorrect reporting, loss of a tax deduction, or worse, auditing by the IRS. In the case of small businesses, such mistakes can lead to financial losses too soon.

The usual risks are:

- Cash flow data that is misleading

- Audits are often caused by reporting discrepancies

- Loss of time in rectifying things that could be avoided.

HelloCategorize, your small business accounting automation that can classify expenses automatically, uses AI to organize expense categories and flag anomalies. This accounting bookkeeping feature minimizes the headaches of financial accuracy while reducing human error, providing you with peace of mind to focus on growing your business.

Why Small Business Accounting Automation Matters

In today’s fast-paced business environment, small business accounting automation isn’t a luxury—it’s a necessity. Manual accounting that takes you hours to sort out the transactions and balance books takes your attention off the real stuff that matters- your business.

By shifting from manual to AI bookkeeping, small businesses unlock greater efficiency, accuracy, and scalability.

HelloCategorize can automate your bookkeeping system, and you will not get lost in smart automation settings:

- Massive grouping of like transactions

- Real-time auto-synching with bank feeds

- Online training to increase categorization rules

- Sophisticated reconciliation programs require books that are always current

This powerful combination of AI tools for small business finance helps reduce human error, deliver financial accuracy, and support better decision-making. It’s time-saving bookkeeping designed to work as fast as you do.

Automated Expense Categorization: How It Works

Automating is key to expense categorization, which means intelligent algorithms are implementing a process to accurately assign financial transactions quickly to the right categories all at once. Rather than manual data sorting, small business finance AI tools also look at vendor names, historical behavior, along with data patterns to do your work for you.

With time, the system learns about your business, the peculiarities of its spending habits, and it becomes better and better. This smart categorization approach will lower human input errors and improve your fiscal accuracy, allowing you better insight for making more reliable decisions.

Time-Saving Bookkeeping with HelloCategorize

You are a one-person firm with time as your most important resource. HelloCategorize will put an end to the hours you would spend every week doing it manually.

- Become more time efficient (5-10 hours a month)

- The tasks in the categorization should be eliminated

- Access clean, actionable data at a quicker rate

Our tool is designed for small business accounting automation freeing you from spreadsheets and manual review so you can focus on growth.

With HelloCategorize, time-saving bookkeeping becomes a reality, not a promise.

Do you still require a Bookkeeper?

Absolutely. AI does not substitute your bookkeeper; it augments him or her. The difference lies in manual vs AI bookkeeping automation handles the repetition, while your bookkeeper focuses on strategy.

By using automated expense categorization tools like HelloCategorize, bookkeepers save time and reduce manual errors. This paves the way to more meaningful activities, such as cash flow planning, advisory activities, and financial forecasting.

With AI tools for small business finance, professionals can deliver more value, faster, and with greater accuracy. It is not a question of humans or software: human expertise needs to be leveraged by means of automation.

The Reasons Why HelloCategorize is the Future of Small Business Finance

HelloCategorize was designed with small business accounting automation in mind, not overloaded enterprise systems. Either as an individual entrepreneur, in charge of a small team, or otherwise, our platform is simple, though not a simplification.

HelloCategorize is an elite preference of small businesses:

- Intuitive, easy-to-use UI: this software is non-accountant-friendly

- An artificial intelligence engine that gets smarter.

- Easy connection to QuickBooks and Xero, and others

- Low-cost packages designed in the context of small business budgets

- Responsive, amiable services when you require them

From time-saving bookkeeping to financial accuracy, HelloCategorize brings big-league intelligence to small business finance, without the complexity.

Automate Your Bookkeeping Now

Your business is being slowed down by manual processes. Make the switch to HelloCategorize the AI-powered solution for error-free, time-saving bookkeeping.

Join hundreds of small business owners already improving their finances with automated expense categorization and AI tools for small business finance.

[Start your free trial] and learn what shape the future of bookkeeping will look like, it will be smarter, quicker, and precise.